FEATURES

Competitive Edge

The Allocator software program is the first on-line Insurance & Super optimiser to be introduced into the Australian marketplace, revolutionising the way Financial Planners and Risk Advisers recommend Life Insurance.

Easy To Use

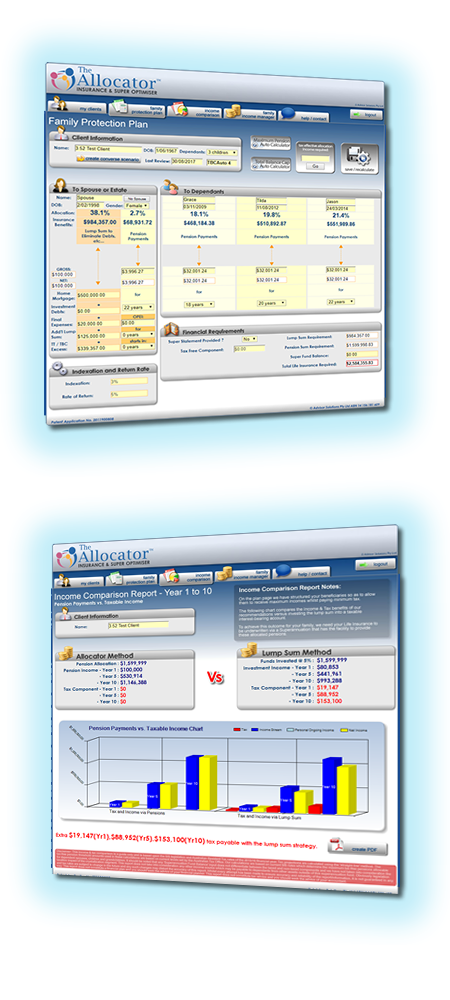

Advisers using The Allocator are able to perform extremely complex Allocated Pension and Taxation calculations, quickly and accurately, with the touch of a button. Precise levels of Life Insurance, beneficiary allocations, family income maximized and taxation minimized.

PDF Reports

A PDF is produced to be used as an addendum to your Statement of Advice. Beneficiary Allocations are clearly illustrated and should be transferred to your client’s ‘Nomination of Beneficiary’ form.

Estate Planner

The Allocator is the perfect tool to help you satisfy the FOFA reforms regarding client reviews, as it is necessary to re-evaluate your client’s circumstances annually particularly as the children get older.

Income Comparisons

The Income Comparison section clearly illustrates to clients the income and taxation benefits over 1, 5 & 10 years that their families will receive by implementing your strategies using The Allocator software.

Plan Comparison

The Family Income Manager allows you to compare your estate plans and see the impact small changes can make to different scenarios, establish a family budget, visually illustrate plan differences to clients and generate reports.

Video Demonstration

BENEFITS

Accountant Benefits

If Accountants are part of your referral network, showing them how The Allocator works can provide them with comfort that the remaining members of the client’s family will continue to be valued accounting clients at the end of the pension term.

For example, if the Accountant tragically loses a ‘mum & dad’ client, they can still keep the SMSF if Death Benefit Pensions have been set up by you, for the children, using The Allocator.

This strategy ensures that the next generation should remain clients of your Centre of Influence once they enter the workforce – after all, their accountant would have been doing their tax returns ever since mum & dad passed away.

Adviser Benefits

You, the Adviser: The Allocator is more comprehensive in determining the client’s requirements, sums insured are generally much higher and revenue can be obtained from superannuation rollovers, insurance commissions and advice fees. At claim time, given the substantial benefits the client will receive, advisers will place themselves in the very best position to take advantage of the following:

- The client wanting to obtain further planning advice utilising the Financial Planning Benefit;

- Assets under Management will increase substantially when the insurance proceeds are deposited into the pension accounts;

- Lesser competition from bank financial planners as the only money the banks will see will be the lump sum to extinguish debt!

Dealer Group Benefits

Everyone wins when you use The Allocator.

The Dealer Group/Insurer/Superannuation Provider: All of these win with The Allocator because the insurance proceeds are retained within the group rather than simply being deposited into a client’s bank account.

Why give money to the competition? They haven’t done any of the hard work to earn it!

Client Benefits

The Client: This will be the first time that many of your clients have seen anything like this. Your clients can potentially benefit from tax-free earnings on their pension accounts, obtain tax-free income into the family, and have all debt extinguished.

What Australian does not want income maximised and taxation minimised for their family when tragedy strikes?

WHAT THEY SAY

START USING THE ALLOCATOR TODAY AND MAXIMIZE YOUR CLIENTS TRUST, SECURITY & BENEFITS

Tax Saved

On Allocator

Client Porfolios

On Allocator

Estate Plans

On Allocator

Advisers Using

The Allocator

PRICING LIST

START USING THE ALLOCATOR TODAY AND MAXIMIZE YOUR CLIENTS TRUST, SECURITY & BENEFITS

Contact Us

Level 1, Suite 14, 10 Benson St, Toowong Qld 4066.

Phone: 0433 265 266 (Craig)

Email: info@theallocator.com.au

Copyright © 2011 - 2017 Skyline Boutique Pty. Ltd